Korean Venture Capital Investment Declines in H1 2023, but Still Up From Pre-COVID Levels

The Ministry of SMEs and Startups (hereinafter referred to as MSS) and the Financial Service Commission (hereinafter referred to as FSC) released the trend report on venture capital investment and VC funds for H1 2023.

Until now, MSS has released quarterly reports on venture capital investment trends in South Korea. However, the report did not include data for venture capital investment under the jurisdiction of FSC. To accurately capture the size of the Korean venture capital investment, the two agencies agreed on aggregating and analyzing the investment performance of all venture capital from H1 2023.

A detailed analysis of venture capital investment for H1 2023 is as follows.

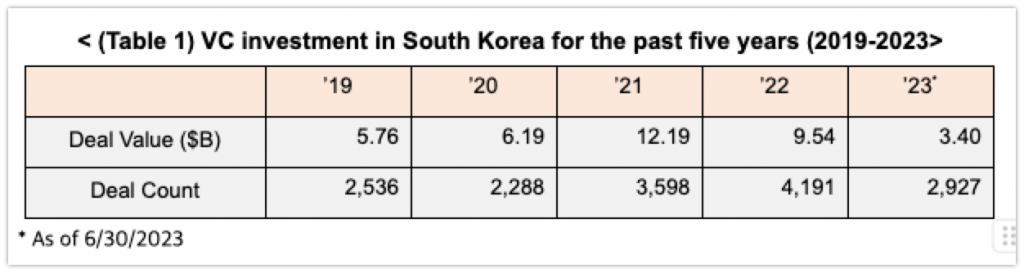

The deal value in H1 2023 was around USD 3.4 billion, a 42% drop from H1 2022. However, it’s important to note that the unusual surge in venture capital investment in major countries worldwide in the previous year was due to COVID-19 liquidity expansion and other factors. The venture capital investment increased by 25% for H1 2023 compared to H1 2019 and 40% compared to H1 2020.

The value of VC funds raised for H1 2023 was about USD 3.5 billion, reflecting a 47% decline from the same period in 2022 but a 35% increase from H1 2019 and a significant 105% increase from H1 2020 .

MORE FROM THE POST

- 2023 Korean Startup Investments Shrink: THE VC Report Highlights

- “2023 Startup Total Investment Amounts to KRW 5.338 Trillion, Halved Compared to Previous Year” – STARTUP ALLIANCE

- South Korea’s Q1 2023 venture investment down 60% year-on-year

- KSF 2023: Sales of 2,237 Members Hit KRW 20T, Investments KRW 29T

- [Official] Korean VC Market Reaches $8.4B in Investment and $9.8B in Fundraising in 2023

Share

Most Read

- 1

- 2

- 3

- 4

- 5

Leave a Reply