South Korea’s Venture Investment Surges 34% in Q1 2025, Driven by AI and Biotech Boom

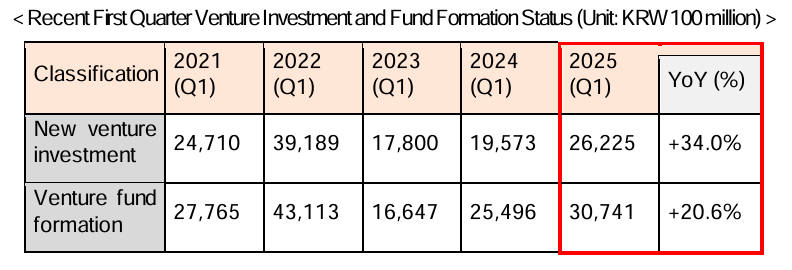

South Korea’s venture capital market demonstrated robust growth in the first quarter of 2025, with new venture investments jumping 34% year-over-year to reach KRW 2.6 trillion (approximately $1.9 billion), according to data released Tuesday by the Ministry of SMEs and Startups (MSS).

The strong performance marks the second-highest quarterly result on record, trailing only the peak year of 2022. Venture fund formation also showed healthy growth, increasing 20.6% to KRW 3.1 trillion compared to the same period in 2024.

Market Recovery Gains Momentum

The impressive first-quarter results build on South Korea’s venture investment recovery that began in 2024, when new investments grew 9.5% after a contraction that started in late 2022. The sustained growth trajectory suggests the market has regained confidence following the post-pandemic adjustment period.

“It is encouraging to see that the scale of venture investment began to rebound from 2024 and that both investment and fund formation continued to grow in the first quarter of 2025,” said Kwak Jae-kyung, Director of the Investment Supervision Division at MSS.

AI and Biotech Lead Investment Surge

The quarter’s standout performance was driven largely by significant investments in artificial intelligence and biotechnology startups. Analysis of major funding rounds reveals that 10 out of 26 unlisted companies receiving investments exceeding KRW 10 billion (38%) were AI or biotech-focused ventures.

Leading the charge was Wrtn Co., Ltd., an AI-powered content creation platform that secured KRW 83 billion in first-quarter funding alone. The company was subsequently selected for MSS’s prestigious ‘Super Gap Startup 1,000+’ program in early May, highlighting its exceptional growth potential.

Another notable success story is CellArk Bio Co., Ltd., based in Wonju, Gangwon Province. Despite being founded only in 2024, the biotech startup attracted KRW 17.1 billion in investment during the quarter, demonstrating the rapid scaling potential in the sector.

Early-Stage Companies Attract Increased Interest

Investment patterns show renewed confidence in early-stage ventures, with funding for companies within three years of founding surging 81.7% compared to Q1 2024. This trend suggests investors are becoming more willing to back nascent technologies and business models.

Sector-wise analysis revealed significant growth in the “video, performance, and music” category, while the “chemicals and materials” sector experienced a decline. However, officials noted that quarterly fluctuations can be substantial due to the impact of individual large-scale deals.

Private Capital Drives Fund Formation

Private sector commitment to venture funds reached KRW 2.6 trillion in the first quarter, representing a 31.1% increase from the previous year. Private contributions accounted for 83.5% of total venture fund formation, underscoring the growing confidence of institutional and corporate investors in the startup ecosystem.

Particularly notable was the increased participation from pension funds and mutual-aid associations, which boosted their commitments by 47.8%, while financial institutions increased theirs by 41.4%. General corporations also stepped up their venture fund participation with a 37.7% increase in commitments.

Looking Forward

The strong first-quarter performance positions South Korea’s venture capital market for continued growth throughout 2025. Director Kwak emphasized the government’s commitment to supporting this momentum through institutional improvements and master fund commitments.

“Going forward, we will steadily implement institutional improvements and master fund commitments to ensure that active investment in deep-tech startups continues and private sector venture fund commitments expand,” he stated.

The data suggests South Korea’s venture ecosystem is successfully navigating the global economic uncertainties while capitalizing on emerging technology trends, particularly in AI and biotechnology sectors that are reshaping the country’s innovation landscape.

MORE FROM THE POST

- MSS Reports Korea’s Venture Investment Rebound in 2024, Outpacing Global Trends

- Korea’s Venture Investment Market Grows by 11.3%, Reaching KRW 8.6 Trillion in Q3 2024

- 2023 Korean Startup Investments Shrink: THE VC Report Highlights

- “2023 Startup Total Investment Amounts to KRW 5.338 Trillion, Halved Compared to Previous Year” – STARTUP ALLIANCE

- Korean Venture Capital Investment Declines in H1 2023, but Still Up From Pre-COVID Levels

Share

Most Read

- 1

- 2

- 3

- 4

- 5

Leave a Reply