- Funding Stage : Seed

- Raising amount : KRW 1B

- Desired Fundraising Timeframe : 3Q 2025

Recent advancements in cancer treatment highlight targeted and immune therapies, with antibodies at the core. Antibodies bind to specific antigens, and if these antigens are abundant on cancer cells, the antibody can target them. When conjugated with a drug, the antibody enters the cancer cell, releases the drug, and kills the cell. This mechanism drives antibody-drug conjugates (ADCs).

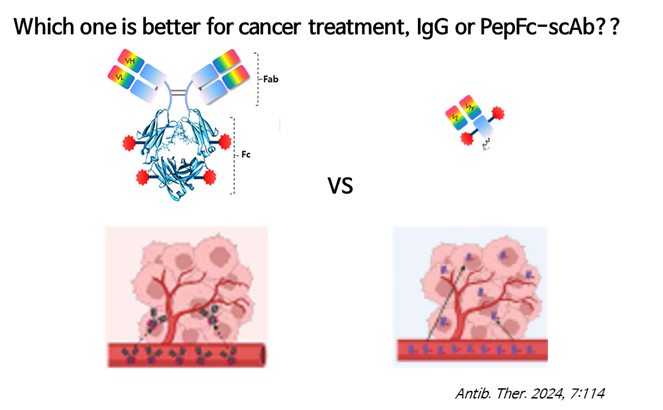

Antibodies vary, with immunoglobulin G (IgG) being prominent, recognized by its Y-shape. The Y’s upper arms, called Fab (Fragment antigen-binding), bind antigens, while the lower stem, Fc (Fragment crystallizable), extends half-life and recruits immune cells like macrophages and NK cells. When an antibody binds a pathogen’s antigen, the Fc draws immune cells to attack, aiding the body’s defense.

Despite progress, antibody technology faces challenges. Today’s focus, AbFinder Therapeutics, tackles critical issues: antibody miniaturization, half-life extension, and toxicity reduction. Founded in October 2024 by Seong-ku Han, a biochemist with a Ph.D. from Kookmin University and former antibody development lead at IMBioLogics, AbFinder (short for Antibody Finder) aims to develop optimal antibodies.

Antibodies, composed of Fab and Fc, have a large molecular weight of 150 kDa, making penetration into dense tumors difficult. To address this, smaller antibodies are needed, but reducing Fab’s size, which binds antigens, is challenging. Han explains, “We developed a peptide to replace the 50-kDa Fc, with a molecular weight of just 2 kDa, enabling easier penetration into tumor cells.” Named “PepFc”, which means Fc made by peptide, this technology enhances accessibility.

Replacing Fc with a peptide has drawbacks, as natural Fc extends antibody half-life to about two or three weeks. Without it, half-life drops to hours. AbFinder designed its peptide to retain Fc’s recycling mechanism, ensuring prolonged half-life without Fc.

Fc also causes toxicity in ADCs, as it binds Fcγ receptors (FcγR) on healthy cells, triggering immune attacks. A notable case is Enhertu’s link to interstitial lung disease (ILD). Han emphasizes, “Our product eliminates FcγR binding, preventing harm to healthy cells.”

These are complex challenges. AbFinder’s co-founders, with decades of antibody research experience, developed PepFc and offer antibody discovery and contract services. Their expertise fuels their ambition.

AbFinder targets global biotech firms, including ADC developers and companies like Amgen, which created bispecific T-cell engager (BiTE) antibodies. Amgen’s BiTE, lacking Fc, has a short half-life, a problem PepFc could solve, Han suggests. Success here would be a milestone for Korean biotech.

WowPartners selected AbFinder Therapeutics as a “WowNext 1st Cohort” company, citing Han’s expertise, the ADC market’s growth, and PepFc’s potential.

Introducing biotech startups, especially in ADC and antibodies, is complex. Readers with questions should meet Han and his team to explore their expertise and vision.

What problem is AbFinder trying to solve?

The antibody drug market thrives with immune therapies and ADCs, but unmet needs persist. These stem from technical stagnation, as most drugs, including ADCs, rely on the IgG format.

While IgG offers advantages, its 150-kDa size limits tissue penetration, reducing solid tumor treatment efficacy. Miniaturizing antibodies by removing Fc sacrifices recycling, slashing half-life. Amgen’s Blincyto, for instance, has a 2.1-hour half-life versus two months for standard antibodies. A solution for miniaturized, long-acting antibodies is needed. AbFinder’s PepFc platform addresses this, alongside ADC off-target toxicity (e.g., Enhertu’s ILD) and bispecific antibody productivity issues, enabling innovative antibody drugs.

Additionally, rising demand for ADC antibody discovery and engineering prompted AbFinder to develop the AbFinder platform to meet market needs efficiently.

How does it solve this problem?

AbFinder replaces IgG’s Fc with the PepFc platform. This 2-kDa peptide replicates the 50-kDa Fc’s recycling function, allowing miniaturization while preserving antigen binding and half-life, boosting treatment efficacy. By eliminating FcγR binding, PepFc avoids off-target toxicity in IgG-based ADCs.

What are AbFinder’s competitive advantages and technical strengths compared to competitors?

PepFc’s key advantage is its 2-kDa peptide, enabling half-life extension and FcγR exclusion, vastly improving tissue penetration. Unlike IgG antibodies, which struggle to infiltrate dense tumors, PepFc’s small size excels. For monoclonal or bispecific antibodies, PepFc enables single-polypeptide production, unlike IgG’s multi-chain assembly, enhancing productivity.

IgG drugs require animal cell production due to N-glycosylation, but PepFc, free of post-translational modifications, allows production in E. coli, cutting costs.

The AbFinder platform outperforms traditional antibody discovery. Conventional libraries mix human germline frameworks with random CDR regions, yielding lower productivity and stability. AbFinder’s library, built with founder expertise, ensures high productivity and stability. The team’s experience with high-difficulty antigens like GPCRs and immune checkpoints strengthens its edge.

What products/services does AbFinder offer, and what is their current status?

AbFinder offers three services: PepFc platform licensing by pipeline or molecule, AbFinder-based antibody discovery and engineering services, and licensing or co-development of proprietary pipelines.

PepFc has completed in vitro proof-of-concept (PoC) and will enter in vivo PoC post-funding. AbFinder finalized two proprietary antibody libraries, validated their suitability, and is developing pipelines. Four innovative drug pipelines (two per platform), focused on cancer, will expand to autoimmune diseases and GLP-1 obesity drug bio-betters after funding.

What is the target market size, and who are the core customers?

The biopharma market reached USD 570 billion (KRW 798 trillion) in 2023, with antibody drugs at USD 230 billion (KRW 322 trillion). By 2032, these are projected to grow to USD 1.18 trillion (KRW 1,652 trillion) and USD 790 billion (KRW 1,106 trillion), respectively.

AbFinder targets the antibody drug market, starting with ADCs, and plans to expand to GLP-1 obesity drugs and protein therapeutics. As a red biotech startup, it focuses on B2B, targeting ADC developers, antibody drug firms needing innovative technology, and Amgen, whose BiTE platform could benefit from PepFc’s half-life solution. Future customers include protein drug developers needing long-acting platforms.

What is our business model?

AbFinder operates a B2B model with three streams: licensing PepFc by pipeline or molecule, offering AbFinder-based research or co-development, and licensing proprietary pipelines.

PepFc-based pipelines improve existing drugs’ shortcomings, leveraging proven safety and efficacy for pre-clinical licensing.

What are our team’s achievements?

In under six months since founding, AbFinder developed two platforms, filed one patent, and applied for two trademarks. It was selected for WowNext 1st Cohort, Shinhan SquareBridge, and the 16th Kibo Venture Camp, and joined Dassault Systèmes’ global collaboration program. Despite limited promotion, AbFinder is negotiating a research contract. To optimize R&D, it formed an academic-industry consortium in January 2025 and is discussing SI investments and collaborations with two firms.

What is the AbFinder team’s competitiveness?

Han, with 18 years in protein research, led R&D at a KOSDAQ-listed firm, covering most drug development stages. Co-founders, former lab colleagues, bring extensive antibody engineering experience. The team has developed antibodies for ~30 antigens, including complex ones like GPCRs. Their expertise, innovation drive, and confidence are key strengths.

AbFinder’s core values—honesty and performance—ensure rigorous R&D and stakeholder value. Its pioneering PepFc technology is a global first.

Why should we receive investment? Three reasons!

First, post-funding, AbFinder’s value will soar. PepFc’s in vitro PoC is complete, and funding will enable in vivo PK and efficacy tests, with results expected in a year, significantly boosting valuation.

Second, AbFinder offers a unique solution to market challenges. PepFc resolves IgG limitations, revolutionizing antibody drugs, and extends to GLP-1 bio-betters, supporting B2B growth and 2030 M&A exit strategies.

Third, its business is stable. Unlike pipeline-focused red biotechs, AbFinder’s B2B model, like Alteogen or LegoChem, ensures steady revenue. AbFinder’s discovery services ease early cash flow, supporting 2030 M&A and IPO goals.

Anything else to convey to readers?

Drug development is a long journey requiring harmony among experts and vast resources. As a startup, AbFinder embraces open innovation. Companies interested in our platforms or co-research are welcome to contact us to advance human health together.

MORE FROM THE POST

- [Korean Startup Interview] CrossPoint Tackles Key ADC Market Issue with Fc Silencing Tech, Attracting Global Biotech Interest

- AbFinder Therapeutics Secures Seed Funding to Advance Next-Generation Biopharmaceutical Platforms

- CrossPoint Therapeutics Selected Deeptech TIPS to Advance Next Generation ADC Technology

- TRIOAR Raises $16M in Series B to Advance Antibody-Based Drug Development Platforms

- [Korean Startup Interview] SimfliBIO Challenges NGS with Advanced Liquid Biopsy for Global Cancer Diagnostics Market

Share

Most Read

- 1

- 2

- 3

- 4

- 5

Leave a Reply