MSS Selects 13 Global VCs to Invest Over $1.9B in Korean Startups via Expanded Global Fund

South Korea’s Ministry of SMEs and Startups (MSS) announced the selection of 13 overseas venture capital (VC) firms to manage its Global Fund, with plans to channel up to approx. USD 1.9 billion(KRW 2.7 trillion) into Korean startups.

Launched in 2013, the Global Fund was designed to help Korean startups attract foreign investment. VC firms that receive capital from the fund of funds, which is backed by the government’s Korea Venture Investment Corp. (KVIC), are obligated to invest an amount equal to or greater than the government’s contribution specifically in Korean startups. To date, 652 Korean startups have received investments totaling approx. USD 9.3 billion(KRW 13 trillion) through this initiative.

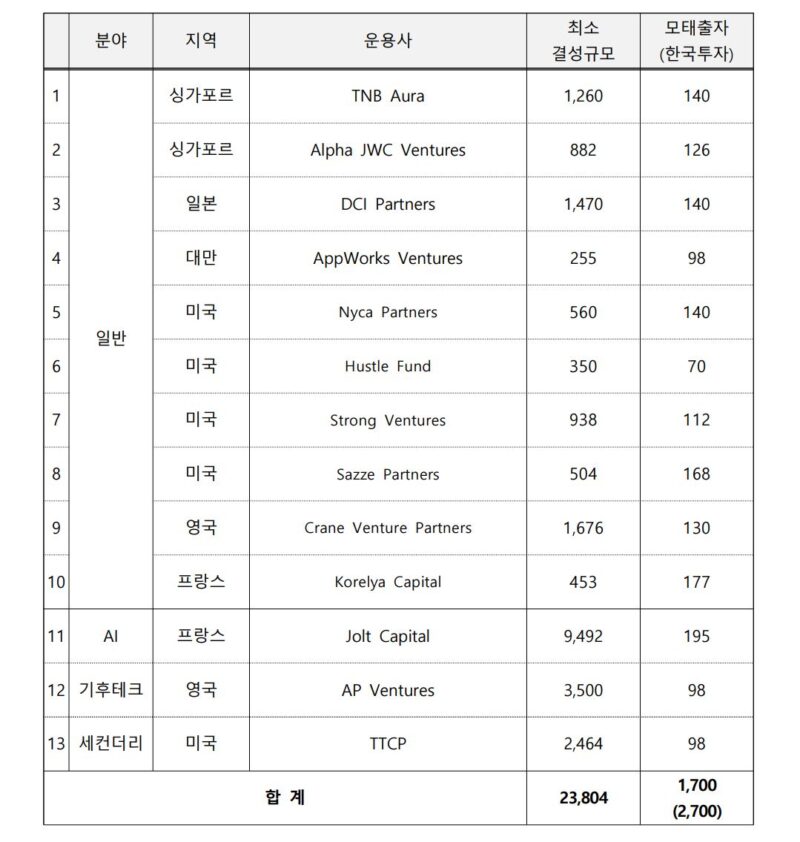

To further boost investment, MSS has raised the 2025 allocation for the Global Fund to a record approx. USD 1.2 billion(KRW 1.7 trillion). New strategic areas such as Artificial Intelligence (AI), climate tech, and secondary investments have been introduced. Thanks to this expansion, the AI fund led by France’s Jolt Capital is expected to surpass approx. USD 6.5 billion(KRW 9 trillion) in size. Overall, the total fund formation is projected to reach approx. USD 17 billion(KRW 24 trillion), with mandatory investment in Korean firms exceeding approx. USD 1.9 billion(KRW 2.7 trillion).

The 13 selected VCs come from six countries, including TNB Aura from Singapore, DCI Partners from Japan, and AP Ventures from the UK. The funds are categorized as General (10 firms), AI (1 firm), Climate Tech (1 firm) and Secondary Investments (1 firm).

Selected firms must form their respective funds within six months of the official announcement date on September 5. An extension of up to six additional months may be granted following a formal review if the fund is not formed within the initial timeframe.

Minister Han Seong-sook of MSS stated, “The Global Fund not only supports startup fundraising but also helps build vital networks with global investors. We will continue to expand this program to position South Korea as one of the top four global VC powerhouses and accelerate Korean startups’ access to global capital and markets.”

MORE FROM THE POST

- Korea’s MSS Partners with TÜV Rheinland to Boost SMEs’ Entry into EU AI Medical Market

- MSS of Korea Enhances Support for Super Gap Startups in AI, Quantum and Space Sectors

- Korea’s MSS Unveils 2025 Scale-Up TIPS Program to Boost Tech Startups

- MSS Advances AI and Quantum Computing for Drug Development and Biotech Growth

- COMEUP 2024 Showcases Innovation Beyond Borders With Record Global Participation

- AI

- AP Ventures

- climate tech

- DCI Partners

- EN

- Global Fund

- Jolt Capital

- Korea

- Korean startup

- MSS

- secondary investments

- TNB Aura

Leave a Reply