Go2Joy: “Pioneering Hourly Hotel Bookings to Transform Vietnam’s Hospitality Industry”

Southeast Asia’s hospitality sector is undergoing a digital revolution, with innovative platforms emerging to bridge the gap between traditional accommodation services and evolving consumer demands. While major online travel agencies (OTAs) have primarily focused on premium hotels serving tourists, a substantial market segment—local demand for budget accommodations including 1-2 star hotels, motels, and boutique properties—has largely been left behind in the digital transformation wave.

This overlooked segment represents over 90% of Vietnam’s 57,000 hotels, traditionally operating through offline walk-in bookings and missing out on the efficiency and reach that digital platforms can deliver. The challenge becomes even more pronounced with hourly booking services, which are commonplace in local markets but have been systematically ignored by mainstream booking platforms designed exclusively around overnight stays.

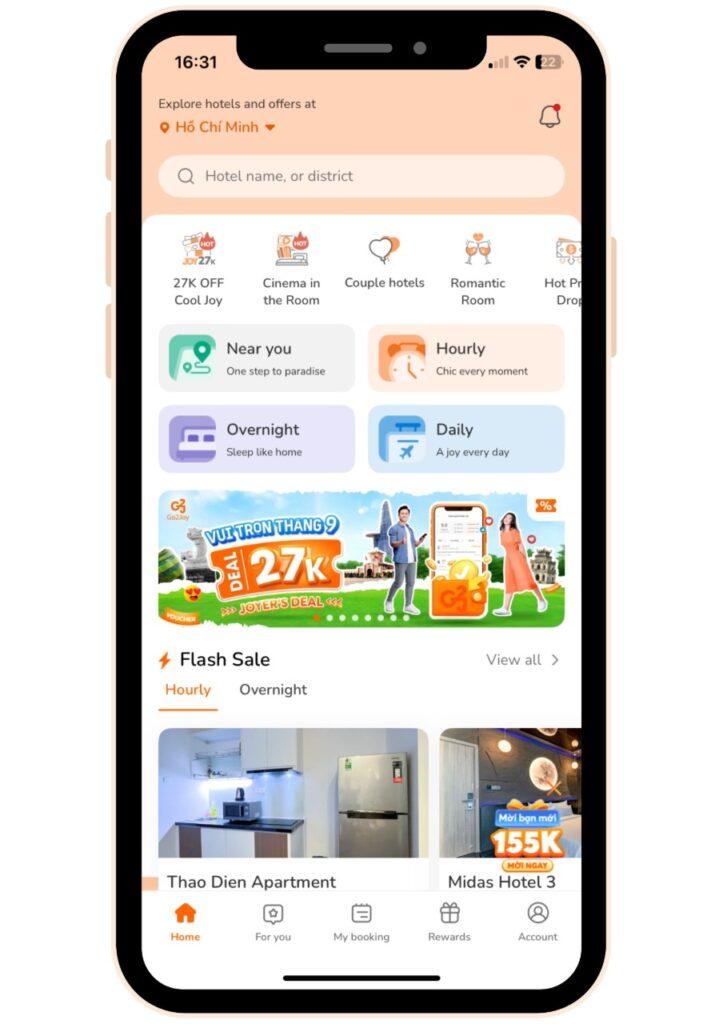

Enter Go2Joy—a game-changing platform that has become Vietnam’s leading hourly hotel booking service, boasting partnerships with over 5,500 hotels across 40 cities and serving 2.2 million users. The company has successfully digitized a market worth over $2.5 billion annually in Vietnam alone, with projections indicating growth to $8+ billion as the economy develops and hospitality standards evolve.

Go2Joy is currently participating in the 2025 Tourism Global Challenge Program, organized by the Ministry of Culture, Sports and Tourism and Korea Tourism Organization, and operated by CNTTech. Through this program, the company has gained invaluable insights into global expansion strategies and forged strategic partnerships. A recent China roadshow facilitated connections with major Chinese OTAs, opening doors for potential collaborations and investment opportunities that could accelerate their regional expansion plans.

What specific problem is your team addressing in the hospitality market?

We’re tackling the digital transformation gap that exists in Vietnam’s hospitality industry, specifically focusing on local hotel demand and the budget properties—1-2 star hotels, motels, and boutique accommodations—that serve this market. While these establishments vastly outnumber premium tourist hotels, they’ve been systematically excluded from the OTA-driven digital revolution that has transformed the upper end of the market.

Our primary focus centers on local hotel demand, which demonstrated remarkable resilience even during the COVID-19 pandemic and represents a massive untapped opportunity. We believe the question isn’t whether this market will eventually go digital—it’s about who will capture the largest market share when the inevitable transformation occurs. Additionally, we’re creating entirely new revenue streams for hotels by enabling hourly bookings. This serves travelers who need accommodation during gaps between flight schedules and standard hotel check-in/check-out times, as well as those requiring short-term rest facilities. This approach maximizes hotel room utilization and significantly boosts occupancy rates.

How does Go2Joy solve these challenges?

Go2Joy revolutionizes the traditional overnight hotel booking paradigm by introducing flexible hourly reservation capabilities, building upon the existing ‘day use’ culture that’s already popular in local markets. We’re successfully onboarding local hotels that have historically relied on walk-in customers, bringing them onto our comprehensive online platform and accelerating their digital transformation journey.

Simultaneously, we’re enhancing convenience for local hotel users by enabling advance online bookings, while consolidating information about budget accommodations—previously scattered and difficult to locate—onto a single, user-friendly platform. This creates a win-win scenario: users can easily identify their optimal accommodation choice while hotels gain direct exposure to their target demographic, effectively eliminating the information asymmetry that has long plagued this market segment.

What competitive advantages and technical strengths differentiate Go2Joy from competitors?

Unlike existing OTAs that were architected around overnight stays and struggle to adapt, Go2Joy was purpose-built from day one with hourly booking functionality as a core feature. This foundational design philosophy enables us to offer not just flexible hourly bookings, but also traditional overnight stays and our innovative 12-hour Half Day product, providing hotels with significantly more diverse revenue opportunities.

We’ve developed a sophisticated Flash Sale feature that empowers hotels to rapidly fill vacant rooms, intelligently segmented between hourly and overnight categories to optimize both daytime and nighttime occupancy. This functionality has become extraordinarily popular among our hotel partners, driving measurable revenue increases.

Given the repeat-purchase nature characteristic of the local hotel market, customer relationship management becomes crucial. We provide AI-powered, hotel-specific CRM functionality—a key differentiator that competitors lack. We’re also developing comprehensive API integrations with local PMS providers who better understand and serve the Vietnamese market’s hourly booking requirements compared to global PMS providers.

For the 50%+ of hotels not yet utilizing PMS systems, we’ve nearly completed development of our proprietary PMS solution. We plan to deploy this as a freemium offering to accelerate market adoption while generating revenue through premium features including advanced Hotel CRM and Channel Manager capabilities.

What products and services does Go2Joy currently offer, and what’s your market position?

We deliver three interconnected core services: our flagship hourly hotel booking platform, a sophisticated advertising platform that helps hotels effectively reach their target customers, and a comprehensive Hotel CRM solution enabling direct customer marketing and relationship management.

Our hourly hotel booking service has achieved the #1 market share position in Vietnam, featuring the country’s largest hotel inventory, most extensive collection of authentic user reviews, and comprehensive coverage across 40+ major cities nationwide. This has earned strong loyalty from both users and hotel partners.

We maintain direct contractual relationships with over 5,500 hotels nationwide, which drives continuous growth in our advertising revenue streams. Our Hotel CRM, currently offered complimentarily, has generated exceptional reception from hotel partners. We’re conducting pilot monetization tests as we prepare to launch this as an additional revenue stream.

Go2Joy has successfully positioned itself as an indispensable service for Vietnam’s digital-native younger generation and the budget hotel sector.

Can you describe your target market size and core customer demographics?

Vietnam’s demographic profile includes 30 million people aged 20-39 within its total population of 100 million. The country hosts 27,000 registered 1-2 star hotels, with Google Maps indicating 57,000 total hotels nationwide—90% of which fall into the 2-star-or-below category. The current addressable market exceeds $2.5 billion annually.

South Korea provides an excellent precedent: Yanolja pioneered online motel market penetration, creating an ecosystem where approximately 30,000 motels now generate over $10 billion in annual revenue. Given Vietnam’s rapid economic development trajectory, we anticipate the current $2.5 billion market expanding to exceed $8 billion annually within the next few years, driven by hotel upgrades and increased per-customer spending power.

Our primary target demographic is the MZ generation (ages 20-39)—the driving force behind Vietnam’s economic transformation. Go2Joy’s strategic vision includes expanding our service portfolio to eventually encompass their evolving needs, including family travel and business trip accommodations.

What’s your business model and revenue structure?

Go2Joy operates on a dual revenue model combining 15% booking commissions with advertising sales revenue. Our roadmap includes diversifying into multiple revenue streams: monetizing our Hotel CRM through a freemium service model and implementing a cost-per-click (CPC) advertising model for enhanced in-platform promotional opportunities.

What key achievements has your team accomplished to date?

We’ve constructed Vietnam’s most comprehensive hotel inventory through direct partnerships spanning 40 cities and 5,500 hotels, while building a user base of 2.2 million customers supported by over one million authentic user ratings and reviews. This infrastructure has established our overwhelming market leadership in the hourly hotel booking sector.

When Agoda recognized the stability and growth potential of hourly bookings during COVID-19 and launched their Day Use products, they couldn’t match our product sophistication and flexibility. Agoda’s offering is limited to predetermined time slots (2, 4, or 6 hours per hotel), whereas our platform provides comprehensive booking flexibility that better serves both consumer preferences and hotel operational needs.

We’ve successfully raised approximately $8.5 million across four funding rounds and earned recognition through selection for prestigious TIPS and Post-TIPS programs, validating both our business potential and technological capabilities. Our current objectives include Thailand market entry and Series B funding targeted for 2026.

What are your team’s key competitive strengths?

Over 90% of our workforce consists of local Vietnamese talent, providing invaluable cultural insight and market understanding. As CEO, I bring over 19 years of specialized ICT market experience in Vietnam, beginning with my role as SK Telecom’s Vietnam representative. This combination delivers unmatched operational stability and market navigation capabilities in the Vietnamese business environment.

While our team may have limited exposure to cutting-edge mobile service development, we’ve achieved exceptional synergy between our enthusiastic, dynamic Vietnamese team members and Korean management who contribute extensive experience with advanced mobile service ecosystems.

What international expansion efforts are you pursuing, and what results have you achieved?

Go2Joy strategically launched in Vietnam rather than Korea and continues expanding throughout Southeast Asia, with Thailand and the Philippines representing our next target markets. Our Vietnam operations have successfully exceeded break-even point (BEP), and we’re leveraging these lessons learned to develop more efficient, cost-effective market entry strategies for Thailand, where we’re currently conducting comprehensive market research and feasibility studies.

How is this program supporting your international expansion objectives?

The Tourism Global Challenge Program’s China roadshow provided exceptional networking opportunities, including meetings with top-tier Chinese OTAs like Trip.com and Tongcheng, while enabling us to present Go2Joy to influential Chinese investors. Given China’s increasing business presence in Vietnam as neighboring economies, these connections create significant opportunities for strategic partnerships and investment attraction that could accelerate our regional expansion timeline.

What are three compelling reasons why investors should invest in Go2Joy?

First, Go2Joy pioneered hourly hotel bookings in Vietnam’s high-growth market and maintains the dominant #1 market position. While Vietnam offers tremendous opportunities, it’s notoriously challenging for foreign companies—global giants like Uber and Gojek exited the ride-hailing market, and even Korea’s successful Baemin withdrew from food delivery. However, Vietnamese markets typically experience explosive growth once a leader establishes dominance, with sustained market leadership patterns demonstrated by companies like MoMo and Grab.

Second, we’re systematically building formidable barriers to entry through our expanding hotel inventory, growing user base, authentic review database, and proprietary booking analytics. These assets enable us to maintain competitive advantages even when serious competition emerges. Given OTA market dynamics, building hotel inventory requires significant time investment, making our 5,500 direct hotel partnerships and million-plus authentic reviews extremely difficult competitive advantages to replicate quickly.

Third, our Vietnam operations achieved monthly BEP in 2024 and annual BEP in 2025, definitively proving our business model’s profitability while simultaneously expanding into Hotel SaaS offerings including CRM, PMS, and Channel Manager solutions. We possess substantial growth potential for expansion into Thailand, the Philippines, and additional Southeast Asian markets.

Go2Joy has successfully established the #1 market position within a challenging Vietnamese market sector through proven local expertise and stable operations. Having exceeded profitability benchmarks with promising growth trajectory, we’re already attracting attention from global OTAs, creating significant potential for strategic M&A opportunities and eventual IPO pathways.

MORE FROM THE POST

- OhMyHotel&Co: “Transforming Asia’s Hotel Industry with All-in-One SaaS Platform”

- LiveAnywhere, “Bridging the Gap Between Short Stays and Long Leases with Flexible Housing Solutions”

- Daebak: “Transforming K-Culture Fandom into Global Business Opportunities”

- Haenyeo Kitchen Group, “Transforming Jeju’s Diving Heritage Into Immersive Culinary Theater”

- LBStech: Building Barrier-Free Cities for Everyone Through AI-Powered Pedestrian Data

Share

Most Read

- 1

- 2

- 3

- 4

- 5

Leave a Reply