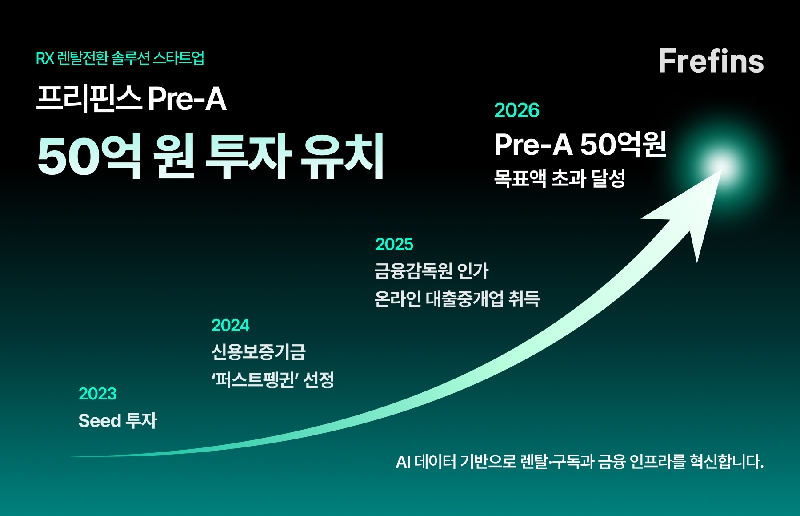

Frefins, a Korean rental transformation (RX) startup, has secured $3.4 million (5 billion KRW) in pre-Series A funding to scale its AI-powered rental finance platform.

Founded by Shin Sang-yong, who previously sold his AI parking management company iPARKING to SK Innovation E&S and NHN, Frefins is transforming how rental businesses access financing through real-time operational data and risk management technology.

The funding round attracted a diverse mix of investors including Hyundai Motor Company Zero1NE Ventures, Korea Credit Guarantee Fund, Honest Ventures, and SG Auto Service (affiliated with Gojin Motors) as new participants, with follow-on investment from existing backer Coolidge Corner Investment. The combination of domestic venture capital, policy finance, and global financial institutions validates Frefins’ data-driven rental finance infrastructure model for both Korean and international markets.

Frefins attributes this successful funding round to its core risk management technology. Since obtaining an “online loan brokerage license” from Korea’s Financial Supervisory Service in May 2024, the company has partnered with multiple financial institutions to broker optimized financial products for corporate clients. When customers apply for structured finance products like ABL (asset-backed loans) or factoring based on their platform operational data, financial institutions assess rental receivables and asset values through Frefins’ risk management solution, then match the best financing options through a competitive bidding process.

This structure simultaneously addresses two chronic challenges in the rental business: capital procurement and risk management. Real-time operational data combined with AI-powered RM solutions improve financial institutions’ assessment accuracy while providing better financing terms for customers, creating a virtuous cycle.

Currently, over 400 rental receivables managed through the Frefins platform are operating without default, with the “rental-finance ecosystem” connecting manufacturers, distributors, and financial institutions expanding rapidly. This breakthrough is particularly valuable for strong small and medium enterprises that previously faced financing limitations due to traditional financial statement-based assessments.

With this investment, Frefins is accelerating its scale-up. The company has completed pilot structure design for a “rental receivables-based mutual loan fund” with multiple private equity firms and financial institutions, now entering the verification phase. Frefins plans to establish actual fund operation cases by 2026 to directly demonstrate the profitability of data-driven rental finance to the market.

Frefins integrates the entire process—from generating trust-based rental data (Ops), standardized receivables verification for financial institutions (Screening), real-time asset control management (Control), to receivables collection and financial capital recirculation (Recycle)—into a unified system. Starting January 2026, the company rebranded its proprietary solution as “Frefins OS,” presenting a vision to establish itself as the industry-standard operating system for rental businesses.

“This funding round with simultaneous participation from domestic financial institutions, policy finance, and global financial firms validates Frefins’ data-driven risk management model,” said Shin Sang-yong, CEO of Frefins. “We aim to establish standards for rental finance, going beyond simple management tools.”

Frefins currently provides solutions to over 200 cumulative clients across various industries including kiosks, robots, home appliances, and medical devices. The company plans to concentrate this investment on R&D, AI development, and recruiting key talent to advance its services. Additionally, Frefins will expand its service portfolio to include rental operation agencies for companies with limited rental experience, B2B2C rental-specialized e-commerce, and marketing support.

MORE FROM THE POST

- ANIAI Raises $4M Pre-Series A to Accelerate Robotic Kitchen Market Expansion in US

- Coxwave Secures $4.8M to Strengthen AI Trust Technology and Agent Verification Platform

- AiderX Secures $6.82M Pre-Series A to Build AI Infrastructure for Customer Behavior Prediction

- HONESTAI Secures $10M to Advance AI-Powered Banking-as-a-Service Platform

- JOOMIDANG Raises $3.8M to Enhance AI Technology and Expand into New Food Markets

- AI

- Coolidge Corner Investment

- finance

- Fintech

- frefins

- funding

- Honest Ventures

- investment

- Korea

- Korea Credit Guarantee Fund

- Korean startup

- mega funding

- pre-Series A

- rental

- SG Auto Service

- Zero1 Ventures

Leave a Reply