[Korean Startup Interview] BS ONE Dominates Korean Ceramic Saggars Market for Battery Cathode Production

- Funding Stage : Pre-series A

- Raising amount : KRW 2 B

- Desired Fundraising Timeframe : 2Q 2025

Cathode and anode materials for secondary batteries, such as those in electric vehicles, have become commonplace terms. However, the “saggar,” a critical consumable in the cathode material manufacturing process, remains less familiar. Yet, saggars are indispensable for producing high-quality cathode materials for secondary batteries.

The global cathode material market is primarily divided into two categories: the “ternary” series, based on nickel-cobalt-manganese (NCM) or nickel-cobalt-aluminum (NCA), and the lithium-iron-phosphate (LFP) series. Korean battery manufacturers predominantly favor ternary cathode materials due to their high energy density, ideal for premium mid- to long-range batteries. To function effectively, the nickel, cobalt, and manganese in ternary materials must form a three-dimensional layered structure that allows lithium ions to move in and out easily. This requires a high-temperature “firing process” at 800°C to 1000°C, necessitating saggars capable of withstanding such extreme heat.

Today’s featured company, BS ONE, specializes in manufacturing ceramic saggars tailored for these high-temperature firing processes. Founded in 2022 by CEO Jaewoo Kim, who has 27 years of experience in mineral material processing at companies like Taeyoung EMC and GMC, BS ONE explores new possibilities in refractory technology.

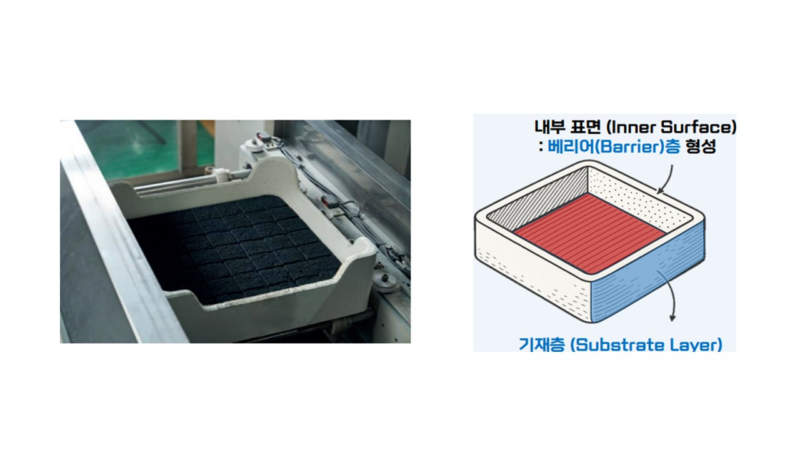

One might wonder if anyone with access to heat-resistant ceramics could produce saggars. However, the challenge is far from simple. Saggars must maintain fire and heat resistance through repeated firings at extreme temperatures. They also need a dense, compact structure to prevent bonding with cathode material metals. If the saggar’s surface is not sufficiently dense, metal particles can infiltrate, compromising cathode quality and reducing the saggar’s lifespan. BS ONE’s competitive edge lies in creating smooth, dense saggar surfaces that resist reactions with ternary metals and withstand the chemical properties of highly reactive lithium ions, ensuring prolonged usability.

CEO Jaewoo Kim noted, “Conventional saggar manufacturers use 0.5~1mm powder to cut costs, resulting in excessive porosity post-firing, which degrades cathode quality. BS ONE prevents lithium-induced erosion and corrosion by incorporating an inorganic barrier layer on the saggar surface.”

Why such focus on this process? The domestic saggar market is dominated by a single company controlling over 70% of the market, leading to delays in tailored technological advancements and short saggar lifespans, prompting continuous demand for better alternatives. CEO Kim aims to transform the domestic cathode saggar market by addressing these needs and capturing market share.

BS ONE has enhanced product quality through extensive Proof of Concept (PoC) testing with cathode manufacturers. This year, it began supplying products to a leading domestic cathode manufacturer, referred to as Company P. If BS ONE continues to meet customer demands, it is poised to attract additional clients beyond Company P.

However, even as BS ONE excels in the domestic ternary cathode saggar market, significant challenges remain. Ternary batteries, which once held over half the global battery market, are losing share to LFP batteries, driven by Chinese manufacturers. BS ONE must supply saggars for the LFP market and compete with China’s low-cost strategies.

To address this, BS ONE is developing saggars for LFP cathode materials, tailored to customer specifications, with plans to supply them starting in 2026. Additionally, BS ONE is capitalizing on the disposability of current saggars by recycling cathode material residues from used saggars and reusing ceramics for new saggars or repurposing them as construction materials or breathable film. Saggars for semiconductor manufacturing are also part of BS ONE’s future business model.

Last year, the domestic cathode saggar market was valued at approximately USD 71 million (KRW 100 billion), with expectations of significant growth as the electric vehicle chasm is overcome. CEO Jaewoo Kim’s vision to disrupt the monopolized saggar market, capture domestic share with customized solutions, and challenge Chinese dominance with LFP saggars is ambitious, and its outcome is eagerly anticipated.

What Problems is BS ONE Addressing?

With the acceleration of global carbon neutrality policies, the lithium-ion battery (LIB) market for electric vehicles and energy storage systems (ESS) is growing explosively, driving demand for cathode materials. Consequently, the need for saggars, essential consumables in cathode production, is surging. Cathode materials are shifting toward high-nickel, high-voltage mid-nickel, and LFP. However, the saggar market’s monopolistic structure has hindered technological advancements since the era of LCO and LMO cathodes, and supply struggles to meet demand due to durability issues in multi-component production lines. BS ONE aims to resolve this monopolistic bottleneck.

Additionally, BS ONE addresses limitations in existing saggars for multi-component and LFP cathode production. High-nickel cathodes, requiring firing at 800°C to 1000°C, expose issues with current saggars: shortened lifespans increase replacement costs and frequency, raising production costs. Lithium compounds cause corrosion, leading to peeling and cracking, which degrades cathode quality. Low thermal conductivity and thermal shock vulnerability hinder uniform heat distribution, affecting cathode performance, while heavy saggars reduce automation efficiency.

The cathode industry urgently needs customized, high-performance saggars to overcome these challenges. BS ONE focuses on delivering solutions to enhance productivity and quality, addressing these critical technical and cost-related issues.

How Does BS ONE Address These Problems?

BS ONE tackles these challenges through two primary approaches.

First, it optimizes raw material selection and blending conditions. Conventional saggars use alumina with large 0.5–1.0mm powder particles to cut costs, resulting in high porosity and poor mechanical properties post-firing. BS ONE counters this by selecting optimal raw materials and varying powder sizes (fine, small, medium) tailored to cathode types, improving properties through reactive sintering.

Second, BS ONE leverages proprietary molding technology. Traditional manufacturers use 1,000-ton hydraulic presses, which are slow and lack precision, limiting quality and productivity. BS ONE employs a self-developed 1,200-ton servo-hydraulic press with automated control, enabling safer, more precise control of porosity and density. This boosts production speed, extends saggar lifespan, and meets cathode manufacturers’ demands for lightweight products.

In summary, BS ONE combines high-quality raw materials with optimized blending and proprietary molding to overcome conventional saggar limitations, delivering high-performance, long-lasting, lightweight saggars optimized for high-nickel cathode production.

What Are BS ONE’s Competitive Advantages Over Competitors?

First, its ability to produce customized saggars. BS ONE develops saggars tailored to high-nickel, high-voltage mid-nickel, and LFP cathodes, unlike competitors’ generic products, maximizing customer production efficiency and product quality.

Second, its multilayer structure with internal surface coating technology. Through years of process optimization, BS ONE creates a substrate layer balancing thermal expansion and strength, and a special inorganic barrier layer to prevent lithium-induced erosion and corrosion. This reduces cracks, peeling, and cathode adhesion, extending saggar lifespan and ensuring cathode quality.

Third, its raw material supply chain network, securing high-quality materials at 30–45% lower costs than domestic prices. This enables cost-effective production and competitive pricing for customers.

Fourth, its ability to create value through used saggar recycling. BS ONE’s technology separates black powder and ceramics from used saggars, recycling black powder for resale and ceramics for new saggars (15–20% reuse) or upcycling into construction materials and breathable films, addressing environmental concerns and creating new revenue streams.

These customized solutions, advanced coating technology, cost-competitive sourcing, and recycling strategy position BS ONE to expand market share in the cathode industry.

What Products/Services Does BS ONE Offer, and What Is Its Current Status?

BS ONE supplies customized, high-performance ceramic saggars for diverse cathode materials. Over the past two years, it has collaborated with cathode manufacturers, completing reliability testing at refractory institutes and production line applications.

Specifically, BS ONE has begun supplying saggars for lithium hydroxide-based high-nickel cathodes. It is developing saggars for lithium carbonate-based high-voltage mid-nickel and LFP cathodes, targeting completion and supply by mid-2026, aligned with customer product launches.

Currently, BS ONE’s products are in the pre-market launch phase. Since July 2023, it has successfully applied saggars in Posco Future M’s refractory institute and Gwangyang cathode production lines, validating performance and reliability. Full-scale supply is set to begin in the second half of 2025.

What Is BS ONE’s Target Market Size and Key Customers?

Driven by global carbon neutrality policies, the expanding EV and ESS markets are fueling explosive growth in secondary batteries and cathode materials, boosting demand for saggars. From 2020 to 2023, the saggar market grew at an annual rate of 48.3%, with projections of 67.3% annual growth from 2024 to 2030, indicating a highly promising market.

By 2026, domestic cathode manufacturers are expected to demand approximately 20 million saggars annually, with a market size of USD 357 million (KRW 500 billion), a fivefold increase from 2023.

BS ONE targets major domestic cathode manufacturers facing challenges with existing saggars, particularly those producing high-nickel, high-voltage mid-nickel, and LFP cathodes, grappling with lithium erosion and high-temperature firing issues. Key customers include South Korea’s Big 4 cathode producers—Posco Future M, L&F, Ecopro BM, and LG Chem—located near BS ONE. Posco Future M, with the largest production capacity, is the primary target, with product suitability certified since late 2023 and full supply planned for late 2025.

What Is BS ONE’s Business Model?

BS ONE operates a B2B specialty materials supply model, focusing on developing and directly selling customized saggars tailored to customer requirements, rather than mass-producing standard products. Each cathode manufacturer requires specific saggar specifications based on furnace type, size, and cathode material. BS ONE leverages a core material platform to offer tailored dimensions and coatings.

This customized model ensures recurring revenue, as saggars, being critical consumables, require periodic replacement. As customer production scales, saggar purchases will increase, providing BS ONE with stable, predictable revenue and enabling profitable pricing due to enhanced customer productivity from longer-lasting saggars.

Additionally, BS ONE plans to launch a recycling business with customers, collecting used saggars for resource recovery. Currently, used saggars are landfilled or partially recycled in ready-mix concrete, but BS ONE’s technology will maximize value through recycling and upcycling, creating additional revenue streams.

In conclusion, BS ONE’s integrated saggar process—manufacturing, sales, collection, recycling/upcycling, and resale—maximizes recurring revenue and added value. This technology will support global expansion with cathode manufacturers, aiming to become a leading ceramic saggar and recycling specialist.

What Are BS ONE’s Achievements to Date?

BS ONE has made steady progress in technology development and commercialization, achieving several key milestones.

On the business front, in 2022, BS ONE signed an MOU with Pohang City, securing a 75,000m² site in the Blue Valley National Industrial Complex for its future production facility, establishing a stable manufacturing base.

Technologically, BS ONE filed a patent for “Lithium-Ion Battery Cathode Saggars” and was selected for government R&D programs like Didimdol, Pre-TIPS, TIPS R&D, and Startup-Centric University, earning recognition for its innovation. It also filed a patent for “Extracting Cathode Residues from Used Saggars via Wet Grinding,” laying the foundation for eco-friendly operations.

Financially, BS ONE secured USD 0.45 million (KRW 0.63 billion) in seed funding across two rounds in 2024, reflecting investor confidence in its technology and business model. A critical achievement is the validation from cathode manufacturers. BS ONE successfully completed rigorous reliability testing for lithium hydroxide-based high-nickel products at Posco Future M’s refractory institute and received approval for application in Gwangyang’s cathode production line, proving industrial viability and boosting commercialization prospects. These milestones demonstrate progress across technology, production, funding, and customer validation.

What Is BS ONE’s Team Competitiveness?

BS ONE’s greatest strength is its team of experienced, specialized professionals working in harmony.

CEO Jaewoo Kim, with 27 years in mineral material processing and an MBA, provides clear vision and strategic leadership. The team includes a director with 10 years in mineral material property evaluation, a polymer science master’s graduate with 12 years in material analysis and development, an 8-year veteran in metal product commercialization and testing, a ceramics manufacturing expert, a chemical engineering graduate with certifications in chemical engineering, air quality, chemical analysis, and hazardous materials, and a project manager with 40 years of metallurgical engineering experience. This diverse, technology-driven team drives BS ONE’s innovation.

The decision to start BS ONE came in 2021, amidst the COVID-19 pandemic, when global carbon neutrality policies highlighted the secondary battery market’s potential. Business analysis identified the saggar market as a growth engine, leveraging the team’s mineral processing expertise to form a technology-focused company.

This comprehensive expertise across the material industry, combined with synergistic experience, enables BS ONE to address complex challenges, deliver innovative solutions, and achieve rapid growth.

Why Should BS ONE Receive Investment?

First, the saggar market offers explosive demand. The booming secondary battery and cathode markets drive saggar demand, but supply lags. Domestic cathode manufacturers seek reliable suppliers to reduce costs, improve quality, and diversify supply chains, presenting BS ONE with a significant market entry opportunity.

Second, BS ONE’s differentiated, customized technology addresses core customer needs. Unlike the monopolized market’s limited offerings, BS ONE’s tailored saggars have passed validation with major clients like Posco Future M and L&F. Its recycling technology supports eco-friendly operations and early global expansion with cathode manufacturers.

Third, BS ONE’s proven leadership ensures rapid growth. CEO Jaewoo Kim’s 27 years in mineral processing and 20+ years of B2B dealings with giants like Posco, Posco Future M, KEPCO, Hansol Paper, and Moorim Paper enable swift customer need identification and collaboration, driving fast business growth.

In conclusion, BS ONE’s market opportunity, innovative technology, and proven leadership make it a high-return investment opportunity at its early-stage valuation.

Any Additional Remarks?

Concerns exist about the secondary battery chasm and competition from Chinese saggar manufacturers. Since late 2023, the chasm, EV fires, and charging issues have challenged battery companies globally. Chinese firms, leveraging low-cost materials, have disrupted markets in South Korea, North America, and Europe.

However, battery companies are forming joint ventures, innovating for cost competitiveness, performance, and portfolio diversification. With global carbon neutrality policies, the battery market is expected to recover by late 2025.

To counter Chinese competition, BS ONE has secured a cost-competitive raw material supply chain, reducing costs by 30–45%, and plans exclusive contracts or investments with suppliers for stable delivery. U.S.-China trade tensions offer opportunities for mutually beneficial partnerships.

With cathode manufacturers’ diversifying portfolios, BS ONE’s tailored, high-performance saggars and integrated recycling process position it for rapid growth.

“The battery chasm is a crisis, but also an opportunity!”

MORE FROM THE POST

- [Korean Startup Interview] ASTAR, Marketing AI ‘AVICA’ Certified by Major Corporations… Expanding to SMEs and Global Markets

- [Korean Startup Interview] CrossPoint Tackles Key ADC Market Issue with Fc Silencing Tech, Attracting Global Biotech Interest

- [Korean Startup Interview] SimfliBIO Challenges NGS with Advanced Liquid Biopsy for Global Cancer Diagnostics Market

- [Korean Startup Interview] BYAHT’s Glow.B Revolutionizes Creator Economy with AI-Powered SaaS Platform

- [Korean Startup Interview] ROAI Launches AI Robotics to Revolutionize Manufacturing with One-Click Factory

Share

Most Read

- 1

- 2

- 3

- 4

- 5

Leave a Reply