South Korea’s Venture Investment Reaches $4.08B in H1 2025, Up 3.5% YoY

South Korea’s venture capital market continued its recovery trajectory in the first half of 2025, with new investments reaching $4.08 billion (KRW 5.7 trillion) according to data released by the Ministry of SMEs and Startups. The figure represents a 3.5% increase from the same period in 2024, marking the second consecutive year of growth since the market began recovering in 2023.

The positive momentum reflects growing confidence in South Korea’s startup ecosystem, driven by strong performance across key sectors including biotechnology, gaming, and artificial intelligence. Minister Han Seongsook noted that the increase in venture investment, combined with significant growth in fund formation driven by greater private capital contributions, represents “a very positive signal” for the market.

Fund formation reached $4.44 billion (KRW 6.2 trillion) in the first half of 2025, posting a robust 19.4% increase compared to the previous year and marking the second-highest performance on record. The growth was primarily driven by increased participation from private sector investors, which rose 22% year-over-year, while policy finance contributions grew by a more modest 8%.

Within the private sector, pension funds and mutual-aid funds demonstrated particularly strong commitment, increasing their contributions by 130% to $4.19 million (KRW 5.82 billion). General corporations also showed renewed interest in venture investing, with contributions rising 58% to $11.7 million (KRW 16.3 billion).

The biotechnology and medical sector attracted the largest absolute increase in investment, gaining an additional $89.2 million (KRW 124 billion) compared to the first half of 2024. However, the gaming sector posted the most dramatic growth rate, doubling its investment volume with a 100% year-over-year increase, highlighting the continued global appeal of Korean gaming companies and technologies.

A notable trend in the investment landscape was the concentration of capital in larger deals. The number of companies attracting investments of $21.6 million (KRW 30 billion) or more increased from just one in the first half of 2024 to five in the corresponding period of 2025. This shift toward larger investment rounds drove the average investment per company up by 29.7% to $21.5 million (KRW 29.9 billion).

Two companies achieved unicorn status during the period, reaching valuations exceeding $719 million (KRW 1 trillion) through their latest funding rounds. Furiosa AI, founded in April 2017, designs and manufactures artificial intelligence semiconductors, specifically neural processing units (NPUs), operating as a fabless semiconductor company. The company’s success underscores South Korea’s growing strength in AI hardware development.

Benow, established in August 2018, became the second new unicorn through its cosmetics manufacturing business. The company operates popular beauty brands including NUMBUZIN for skincare and Fwee for makeup, reflecting the continued global expansion and success of Korean beauty products, commonly known as K-beauty.

The emergence of these unicorns in AI semiconductors and cosmetics demonstrates the diversification of South Korea’s venture ecosystem beyond traditional technology sectors. The success spans from deep-tech hardware development to consumer-facing beauty brands, indicating a maturing market with multiple pathways to achieving significant scale.

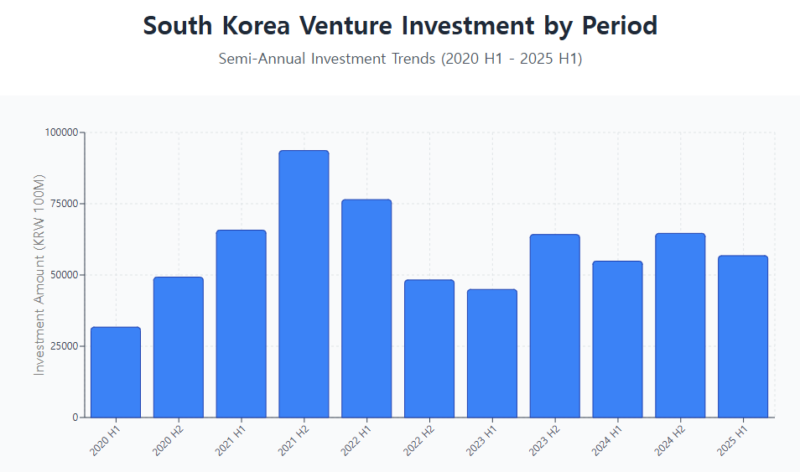

Historical data shows the cyclical nature of South Korea’s venture investment market. After reaching a peak of $114.6 million (KRW 159.4 billion) in 2021, investments declined through 2022 and 2023 before beginning the current recovery phase. The full-year 2024 investment total of $85.9 million (KRW 119.5 billion) established the foundation for continued growth in 2025.

The government’s role in supporting the ecosystem remains significant, though private sector participation is growing. Policy finance contributed $7.15 million (KRW 9.94 billion) to fund formation in the first half of 2025, representing steady but measured government support. The larger growth came from private sources, indicating market-driven confidence in South Korea’s startup prospects.

Minister Han emphasized the government’s commitment to supporting promising companies in their growth and international expansion efforts. “We will continue our policy efforts to ensure that promising companies can grow through venture investment and advance into the global market,” she stated, highlighting the administration’s focus on fostering globally competitive Korean startups.

The sustained growth in both investment volume and fund formation, combined with the emergence of new unicorns across diverse sectors, suggests that South Korea’s venture ecosystem is not merely recovering but evolving toward higher-value, more sophisticated investments. The increased average deal size and strong private sector participation indicate growing investor confidence in the market’s long-term prospects.

For international observers, South Korea’s venture market presents a compelling case study in post-pandemic economic recovery within the technology sector. The country’s strength in semiconductors, gaming, beauty, and biotechnology creates multiple avenues for continued growth, while strong government support provides stability for long-term investment strategies.

The data indicates that South Korea’s venture ecosystem is positioning itself as a significant player in the global startup landscape, with particular strength in technology sectors that are increasingly important to the global economy. As the country continues to produce unicorn companies and attract growing levels of investment, both domestic and international investors are taking notice of the opportunities within South Korea’s dynamic entrepreneurial environment.

MORE FROM THE POST

- South Korea’s Venture Investment Surges 34% in Q1 2025, Driven by AI and Biotech Boom

- MSS Reports Korea’s Venture Investment Rebound in 2024, Outpacing Global Trends

- Korea’s Venture Investment Market Grows by 11.3%, Reaching KRW 8.6 Trillion in Q3 2024

- 2023 Korean Startup Investments Shrink: THE VC Report Highlights

- “2023 Startup Total Investment Amounts to KRW 5.338 Trillion, Halved Compared to Previous Year” – STARTUP ALLIANCE

Leave a Reply